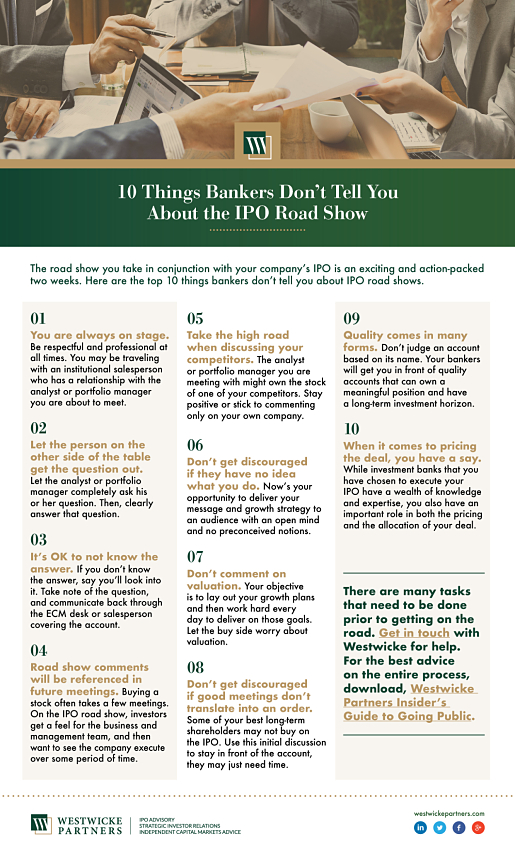

10 Things Bankers Don’t Tell You About the IPO Road Show

In conjunction with your company’s initial public offering (IPO), your two-week road show will take you across the country and put you in front of hundreds of potential investors. To prepare you for the trip, your bankers will make sure you know the ins and outs of your “story.” However, to make your meetings successful, you’ll want to be aware of a few more tips for success. Here are 10 things you should keep in mind during those IPO road show meetings.

Leave a Reply